When and how will the chip shortage end?

Historians may spend decades harshly criticizing the impact of the pandemic, while the chip shortage caused by the pandemic is likely to last longer. Many analysts agree that the worst chip shortage will ease in the third or fourth quarter of 2021, but most of 2022 will need to solve the problems that exist in chips from supply chain to product.

To alleviate supply shortages, it will not rely on the large national and regional investments currently underway in South Korea, the United States and the European Union, but on older chip factories and foundries that are not technologically advanced and can only handle smaller wafers.

Before we explore how to solve the chip shortage, it is necessary to summarize how the problem began.

As panic, lockdowns, and general uncertainty caused by the pandemic swept across the world, automakers canceled orders. However, this situation means that a large portion of the workforce is starting to work from home, buying computers, displays, and other equipment. At the same time, the entire teaching system is also changing to a virtual teaching model with the help of laptops and tablets. Additionally, more time at home means more time spent on home entertainment such as televisions and game consoles.

These factors, combined with the rollout of 5G and the growing cloud computing, have quickly absorbed the capacity that automakers have inadvertently freed up. When automakers realize that people still have to buy their products, they find themselves at the end of the long line for chip purchases.

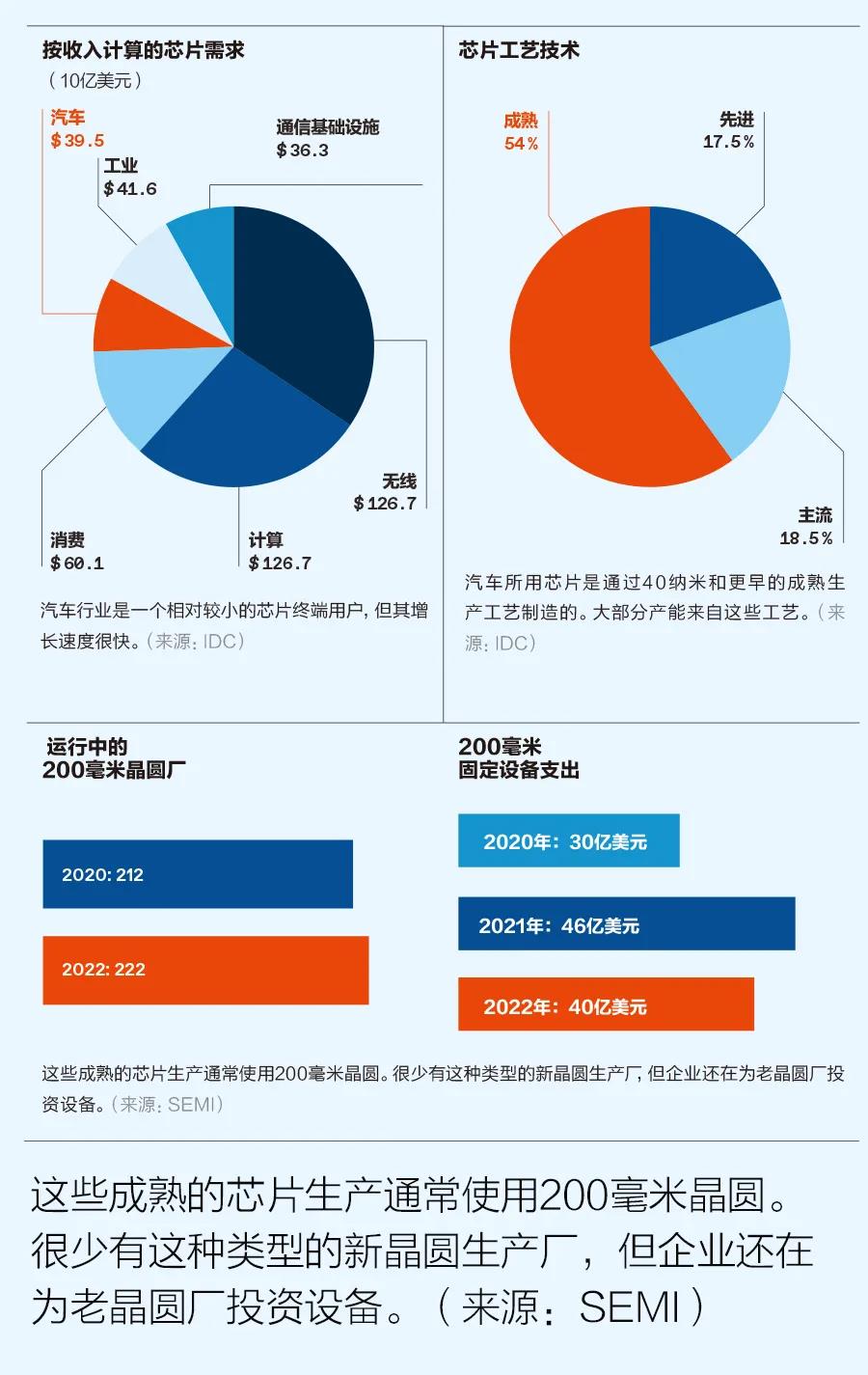

Market research firm IDC said that in terms of revenue, the automotive industry's chip demand was $39.5 billion, accounting for less than 9%. By 2025, this number will increase by 10% per year.

But the automotive industry employs more than 10 million people worldwide, and consumers and politicians alike are very sensitive to it, especially in the United States and Europe.

Chips used in the automotive industry have manufacturing processes that require safety standards that differ from those of other industries. However, they are produced on the same production line as analog integrated circuits, power management chips, display drivers, microcontrollers, and sensors used in other industries.

"They all use a 40nm or earlier manufacturing process." Mario Morales, vice president of application technology and semiconductors at IDC, said. This chip manufacturing technology is about 15 years behind the current state-of-the-art technology.

IDC's survey shows that the production lines that manufacture chips at these old process nodes account for 54% of the total installed capacity. Nowadays, these old nodes generally use 200mm wafers. To reduce costs, the industry began to move to 300mm wafers in 2001, but much of the 200mm wafer infrastructure still exists and has even expanded.

The automotive industry, despite being in a desperate situation, did not have the urge to build new 200mm fabs. "The investment income is not here." Morales said. In addition, China has many old node factories that do not operate efficiently, but "in a sense, this will further reduce the incentive to build new ones."

The International Semiconductor Equipment and Materials Association (SEMI) expects the number of 200mm fabs to increase from 212 in 2020 to 222 by 2022, about half of the projected growth of the more profitable 300mm fabs.

Increasing the production capacity of existing 200mm fabs would make more sense than building new ones, and there are signs that this is happening. Christian Gregor Dieseldorff of SEMI predicts that more than 40 companies will add more than 750,000 wafers per month from the beginning of 2020 to the end of 2022.

The long-term trend by the end of 2024 will be for 200mm fabs to increase production capacity by 17%. In 2020, investment in equipment for these plants exceeded the $3 billion mark for the first time in years and is expected to increase to $4.6 billion in 2021, SEMI said. However, by 2022, the investment will fall back to $4 billion. In comparison, the estimated investment in 300mm fab equipment in 2021 will reach $78 billion.

While there is a shortage of chips, various countries and regions are also trying to promote the production of logic chips.

South Korea has unveiled a $450 billion 10-year plan, the United States will introduce a $52 billion bill, and the European Union may invest $160 billion in its semiconductor industry. Chipmakers have ushered in a consumption boom.

According to SEMI's survey, in April 2021, global semiconductor production fixed equipment increased by 56% year-on-year. In its World Fab Forecast on June 3, 2021, the organization said that 10 new 300mm fabs will start operating in 2021 and 14 more in 2022. "Promoting integrated circuit production capacity around the world will definitely push fab investment in the current decade to a new level," said Disseldorf, senior principal investigator of semiconductors at SEMI. In the coming years, we will see record investments and more announcements of new fab construction.

Jim Feldhan, president of market research firm Semico Research, said there could be potential problems on the way to ending the chip shortage, and some of the soaring demand could come from customers doubling down on orders to increase inventory. I don't know which product is in demand twice as much as the previous year's analog. However, he said, producers "don't want a 12-cent part to hinder the production of 4K TVs," so they will stock up.

The automotive industry has to do more than just stock up. Bharat Kapoor, lead partner of the Americas High Technology Practice at global strategy and management consulting firm Kearney, said that to avoid shortages in the future, top executives in the chip industry and the automotive industry need to establish more direct connections to make supply and demand signals clearer.

CN

CN

EN

EN