How to save the pain of chip shortage in China's communication industry

The U.S. Department of Commerce prohibited U.S. companies from selling components, software and technology to ZTE within seven years, making China's communications industry feel the pain of "lack of cores".

The bad news isn't just about that. It is reported that the British government has advised domestic telecommunications companies to reduce their purchases of communication equipment from Chinese companies.

In this context, there have been many comments around the development of the chip semiconductor industry in China. There are also many different perspectives on the current development of the domestic chip industry.

This article will introduce the types of chips in the system, the whole life cycle of chip design and the cost of chip manufacturing as the starting point, combined with the development of the Internet of Things, in view of the current two hot events of ZTE's "core" pain and the communication chip giant Qualcomm's proposed acquisition of NXP, and put forward some of its own thoughts on China's chip industry.

Chips are a broad concept that involves different industries and applications. In order to give readers a global understanding of China's chip industry, here is an introduction to the types of chips.

Chips are divided into different categories, large and small. To sum up, it can be roughly divided into 4 categories:

1. Computing chip

The types of computing chips are roughly divided into general-purpose computing chip CPUs, signal processing chips DSP, graphics computing chips GPUs and other special computing acceleration chips, such as Bitmain's Bitcoin miner ASIC chips, or artificial intelligence acceleration chips.

The general-purpose CPU is divided into three branches according to the instruction set:

The x86 series, that is, Intel/AMD series chips, is mostly used in the field of personal computers and servers.

ARM series is mostly used for embedded devices, such as mobile phones, smart terminals and other low-power devices. In fact, more and more embedded devices use ARM architecture, and ARM series chips are considered a chip architecture suitable for IoT devices. It should be pointed out that ARM itself does not sell chips, but uses 2 IP licensing methods to export to the outside world, such as Apple, Samsung and Qualcomm's mobile phone CPUs are compatible with the ARM instruction set of non-public design, and its chip structure itself is completely independently developed. According to reports, the CPU core of Huawei's Kirin 970 chip adopts ARM's public IP licensing model, which is more conducive to timetomarket, but there is no non-public version of the design in terms of design.

MIPS series, our country's self-developed CPUs mostly use MIPS architecture.

Overall, our country has a layout on general-purpose CPUs and GPUs, as well as the latest AI chips, and is not without nothing.

For example, through the acquisition of Imagination Technology, a well-known British Fabless designer, China has acquired a variety of IP cores such as the PowerVR series, MIPS series and communication Ensigma series. Unfortunately, the application field of MIPS architecture is relatively narrow due to the lack of software ecology.

In terms of AI chips, many IC design manufacturers such as HiSilicon and Cambrian have our country successively invested in AI chip design, indicating that a new round of hardware research and development based on IoT edge computing has been launched our country.

2. Memory chip

There are many types of memory chips, and Samsung is a typical representative of this type of chip design and manufacturing vertical. our country enterprises still need to improve on memory chips.

3. Sensor perception chip

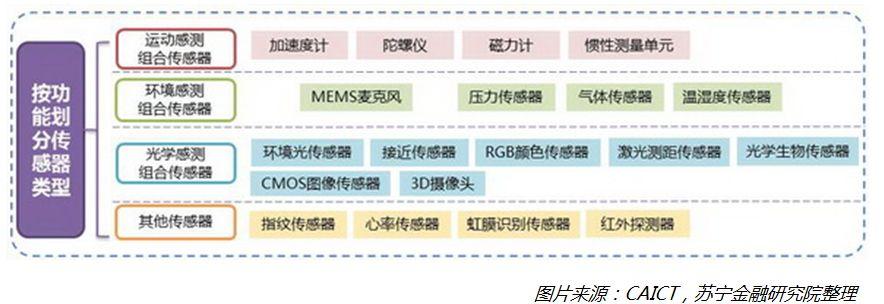

Under the general trend of the Internet of Everything, sensor chips are responsible for connecting various states of the physical world to the Internet electronic information system, which is the entrance to the Internet of Things. Sensor chips can be roughly divided into four categories according to the perception category: motion sensing combination sensor chip, environmental sensing combined sensor chip, optical sensing combined sensor chip, and other sensors (see the figure below for details).

Abroad, integrated sensor giant suppliers include Bosch, STMicroelectronics, NXP and Honeywell, as well as traditional image sensor giant Sony.

From the perspective of market data, China's sensor market was about 10.6 billion US dollars in 2015 and is estimated to be 13.7 billion US dollars in 2019, of which the market share of domestic sensor manufacturers is only 13%, of which most are module manufacturers.

At present, although our country's chip companies are involved in the field of sensors, they are relatively small, and only Goertek in the field of MEMS microphones has a leading technical level and has become a supplier of Apple's iPhone.

4. Communication chip

In the IoT scenario, the communication chip is responsible for connecting data to the Internet wirelessly or wired. ZTE is a communication equipment manufacturer whose main business is to provide wireless communications. For example, Qualcomm's main business is in terminals, and base stations are less involved, while ZTE Huawei is involved in both base station and terminal business.

Since communication chips involve professional chip types in multiple subdivisions such as RF radio frequency, IF intermediate frequency, ADC/DAC, baseband, power management, etc., and there have been many reports related to ZTE's sanctions by the United States, the author will not introduce them one by one here.

It should be pointed out that although the supply of a certain type of chip still depends on foreign suppliers due to yield rate, performance, stability and other reasons, on the whole, our country enterprises have reached the international top level in the field of communication chips, which can be concluded from the 5G standard - when the enterprise has been deeply involved in the formulation of top industry standards, then its level cannot be bad.

Another interesting phenomenon is that according to Gartner statistics, in our country's enterprise chip procurement in 2017, ZTE's chip purchase volume is not in the top ten rankings, which shows that it is not very dependent on imports, which may also be why after the news of ZTE's sanctions came out on April 16, ADI, TI and other stocks in the US stock market were not affected and fell sharply, taking Qualcomm as an example, on April 16, the US stock market closed, Qualcomm shares only fell 1.72%.

So why did ZTE say that the ban may put the company into a state of shock?

So why did ZTE say that the ban may put the company into a state of shock?

It should be noted here that the specific content of the ban is that the U.S. Department of Commerce announced that it will prohibit U.S. companies from selling any parts, goods, software and technology to ZTE.

The author believes that the real weakness of ZTE, and even the real weakness of China's semiconductor industry, is not the chip components themselves, but the EDA software authorization in the chip design and manufacturing process. The following is a detailed explanation of the whole life cycle process of the chip.

1

The full life cycle of chip design

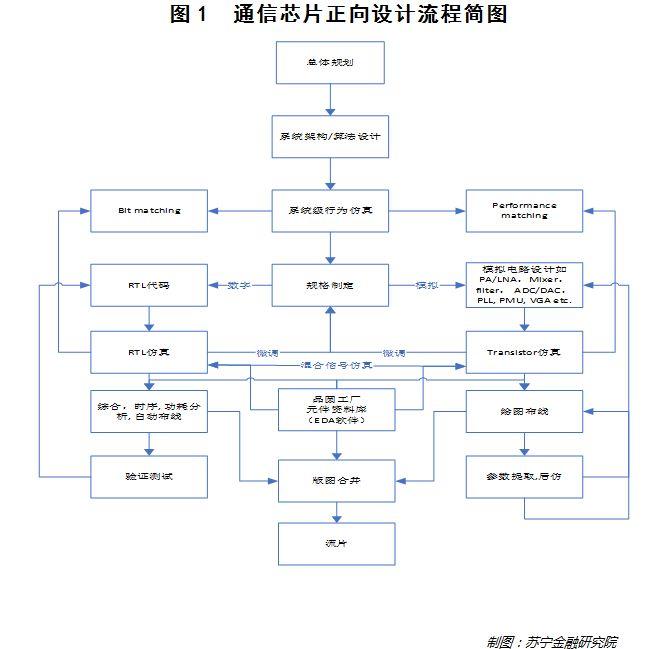

The steps involved in chips from design to manufacturing are extremely complex and professional. Among them, the chip design process is divided into two processes: forward design and reverse design. The reverse design process was originally intended to check for plagiarism by other companies, but was later used by small companies as a way to save R&D funds and quickly copy other chips. In view of the fact that this design process violates the principle of intellectual property protection, this article only introduces the forward design process.

The following is an example of the forward design process of communication chips. Because communication chips involve mixed-signal design, the design process is widely representative.

The design process of communication chips mainly includes the following four main steps:

1. System architecture and algorithm design. System architecture design mainly determines the overall framework and structure of the chip. The software used here mainly includes Microsoft's Office suite such as Word, Excel, etc., as well as some drawing software such as Microsoft Visio to describe the system architecture design idea. Software system architecture design will also involve professional graphical expression languages such as UML. It should be noted that system architecture design also includes system-level algorithm design. It is also divided into software and hardware design, and the above flowchart focuses on hardware design.

2. System behavior simulation. In hardware system design, when the architecture is selected, it is necessary to simulate the design at the system level to ensure that the designed system meets the KPM indicators in the product planning in terms of performance. The software involved here is mainly Mathworks' Matlab and Simulink series, and the Python language is becoming more and more popular because of its open source and free characteristics. Like Matlab and Py

CN

CN

EN

EN